Real reviews from happy customers

48,900 reviews and counting.

4.7 stars in the App Store

Safe driving. Great insurance! I Switched from Geico, paid 6 months upfront and went from $1,100/6 months to $743/6 months.

Connor S.

Trying Root was the best decision I could have made. I now have full coverage while spending $400 less than what I was paying Progressive for only partial coverage.

Jennifer P.

Prices are at least half of what everyone else wants (Progressive, State Farm, etc.) and when our car got destroyed by a fallen tree limb, Root was in touch the next day and had everything done by the end of the week. If I could give more than 5 stars I would.

Tanya P.

Car insurance should be easy, even if your commute isn’t

At your fingertips

Get an auto insurance quote online, then manage your policy and file claims conveniently in the app.

Instantly adjust price levels

Customize your policy with coverages you choose or select a Root recommended plan. See how your price changes with different coverage levels.

Safe driver discount

Good drivers can save big in California. If you’ve stayed safe on the road over the last 3 years, you could qualify for 20% discount on your policy.

Get the coverage you want

Each of our policies includes the state minimum requirements. Then you can add more coverages or change your levels of coverage to make the right policy for you.

No hassle claims

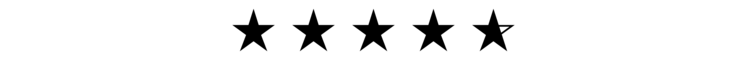

Go to the app

Answer a few questions about the accident.

Take pictures

Get as many angles as you can of your vehicle to show the damage.

Then it’s our turn

We’ll reach out to complete your claim.

State Requirements in California

What are the minimum car insurance requirements in California?

To legally operate a vehicle in California, drivers are required to be able to pay for damages and injuries that they cause in car accidents. There are several options to show proof of financial responsibility, including buying Liability coverage. California requires insurance companies to provide electronic proof of insurance information to the DMV. The DMV uses this record to verify your proof of financial responsibility.

You’re required to show proof of insurance or financial responsibility if you’re stopped by a police officer or involved in a car accident, as well as your driver’s license and car registration. You will also need proof of insurance or financial responsibility when you register your car for the first time or renew a registration.

Since California accepts electronic proof of insurance, you’ll always have legal, hassle-free proof of coverage on hand through the Root app on your phone if you don’t have your printed insurance card with you.

Liability coverage

You are required to carry Liability coverage in California if you’re unable to show any other proof of financial responsibility. If you’re found driving without insurance or proof of financial responsibility, you could face penalties.

Liability coverage helps to pay for property damage or bodily injuries that occur from a car accident you cause. It does not cover harm to you or your family members (that’s what Medical Payments are for) or your vehicle (but Collision and Comprehensive coverages do). These additional car insurance coverages can be much cheaper than the serious expenses that can come with a major accident.

Minimum required Liability coverage in CA:

$15,000 Bodily Injury (for injury/death to one person)

$30,000 Bodily Injury (for injury/death to more than one person)

$5,000 Property Damage

Alternatives to car insurance

If you choose not to carry insurance, you’re required by California law to show proof of financial responsibility. Options to fulfill this requirement (other than Liability insurance) include:

A $35,000 cash deposit with the CA DMV

A Certificate of Self-Insurance from the DMV

A surety bond of $35,000 from any company licensed to do business in California

What is SR-22 insurance?

You may be legally required to file an SR-22 form (also known as SR22 insurance) from your insurance provider if your license has been suspended (or is in danger of suspension) or revoked.

SR-22 requirements vary by type of offense and number of offenses, and they may be required for a specific period of time. An SR-22 is not insurance—it’s a certification filed by your insurance company stating that you will maintain the minimum Liability insurance for a predetermined amount of time. (Root does this for free.)

Failure to maintain your insurance policy with a current SR-22 will result in another suspension of your driver's license. Essentially, the insurance company notifies the DMV that you are no longer keeping your SR-22 current and the DMV penalizes you.

What is the average cost of car insurance in California?

The car insurance rates in the Golden State are the fourth highest in the nation. Drivers in California pay an average of $1,966 [1] per year for their auto policy, but you may qualify for a 20% discount if you have not:

Had more than 1 point on your driving record due to a violation(s).

Taken traffic school because of a traffic violation more than once.

Been the at-fault driver in an accident that resulted in injury or death.

References

Insure.com. Annual average rates were compiled in May 2021

Additional Resources

California Car Insurance (Not a government agency)

Telematics is not used in California; any represented savings from telematics data is not applicable in CA. Referral program also not applicable in CA. Visit joinroot.com/califaq for more information. Roadside Assistance is purchased as separate coverage in CA and NV.